A high-powered panel of leading Indonesian entrepreneurial companies in the B2C and the B2B space, discussed their strategies to realise the potential of the country’s tier 2 and 3 cities, based on a recent report from Alpha JWC Ventures and Kearney

Global investors looking to tap into the potential of Indonesia typically look no further than the Greater Jakarta metropolitan region which accounts for 24% of the over $1.1 trillion national GDP.

However, smart investors would do well to bet big on the country’s hitherto ignored tier 2 and 3 cities. A strong data-backed view of this market comes via a report from Alpha JWC Ventures and Kearney titled ‘Unlocking the next wave of digital growth: beyond metropolitan Indonesia’.

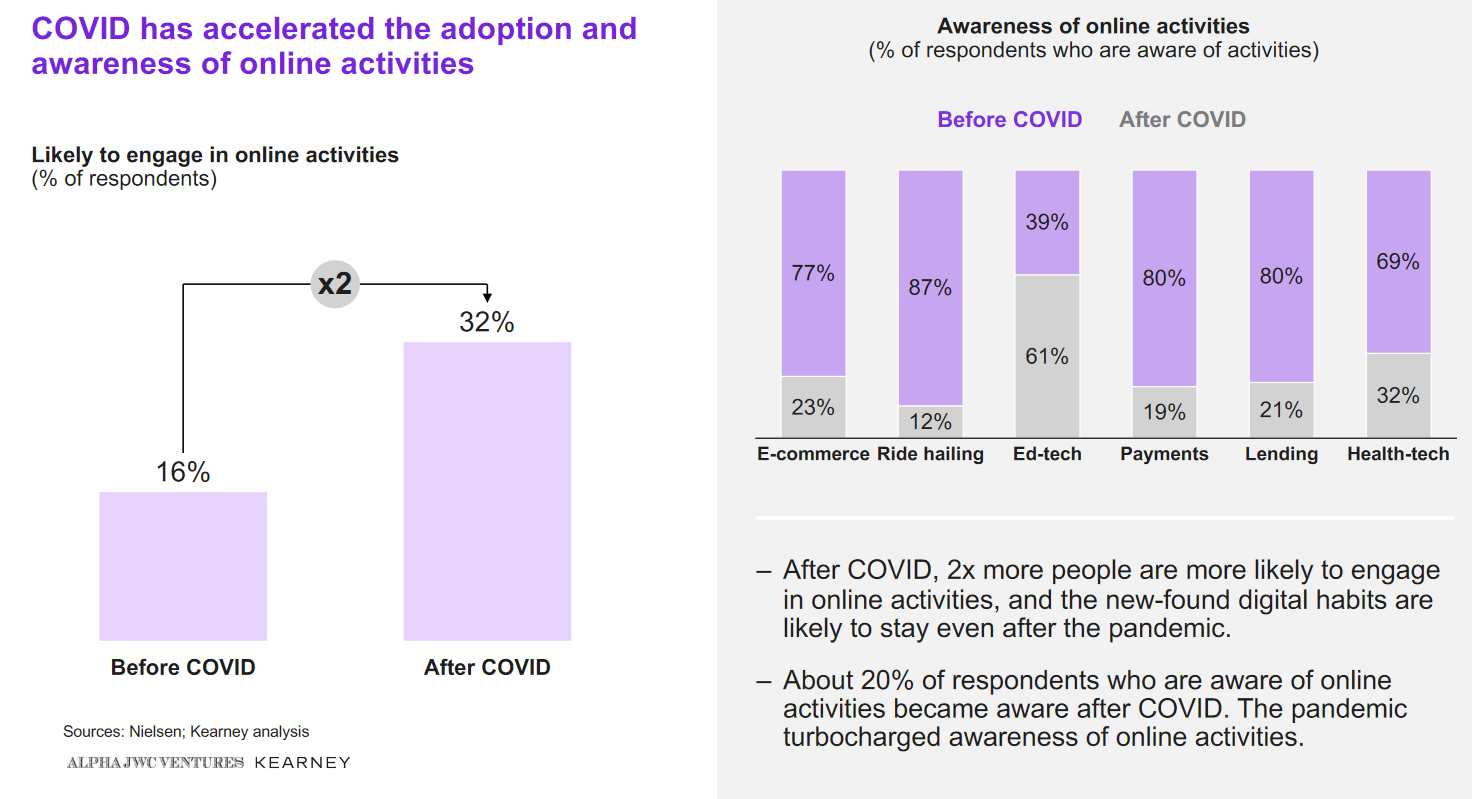

According to the report, “Two to three potential unicorns from ecommerce, lending and SME services will emerge in the next five years on the back of the growth of tier 2 and 3 cities. Ecommerce, lending, and payments will be the biggest categories, while nascent sectors such as edtech and healthtech will see significant growth from a low baseline”

The report also said, “The tier 2 and 3 digital economy is expected to grow by about 5x by 2025. Investors and start-ups could also expect help from macro tailwinds.”

Unlocking the B2C opportunity

To discuss how best these tailwinds could be harnessed for the B2C sector, Alpha JWC Ventures put together a panel discussion featuring Jonathan Barki, Group Head of Product Strategy at Gojek; Umang Rustagi, CEO, Kredivo; Anderson Sumarli, Co-founder and CEO, Ajaib and Gunawan Susanto, Country Manager, AWS Indonesia. The discussion was moderated by DealStreetAsia Editor-in-Chief Joji Philip.

The session was full of practical advice to tackle the tough obstacles that came in the way of addressing these markets. For instance, Kredivo’s Rustagi was clear that Western credit scoring models could not be grafted on emerging markets like Indonesia.

Cloud-based solutions were expected to boom, since they provided an inexpensive and modular way for startups to grow and scale. AWS’s Susanto pointed out that “59% of Indonesian digital workers who are not applying cloud computing skills today, believe they will be a requirement to perform their jobs by 2025.” To meet this lacuna, AWS was giving access to training, by partnering with the government, educational institutions and industry organisations.

With 51% of the population under 30, Indonesia’s young demographic was playing a keen role in capital markets. While only around 1% of Indonesia’s population invested in the capital markets, 70% of this segment was millennials. Explaining this phenomenon, Ajaib’s Sumarli said, “It’s a function of the rising middle class” – a social group dominated by millennials in Indonesia. Ajaib was working on education programs with the IDX to ensure that these new entrants turned from mere dabblers in the stock market to investors who were there for the long haul.

Read on for edited excerpts:

JP: Indonesia has an unbanked population of 180 million people and they are the target for everyone from unicorns to fintechs to startups in the lending space. How much potential do you see, especially for credit lending?

Umang Rustagi (UR): We primarily consider the unsecured lending opportunity, and credit cards are a good proxy. Indonesia is a trillion-dollar economy with a 70-million-to-80-million strong middle class. But only 7 million to 8 million people have credit cards. And only 10 million people have taken a loan from a financial institution. Only 10% of the credit worthy population has access to credit.

The access is limited by the lack of credit infrastructure. You can serve a significant majority of that 70 to 80 million population by building a mobile first solution, with a beautiful digital interface to lower customer acquisition costs, and by leveraging digital alternate data.

As Indonesia becomes a middle-income country, traditional financial institutions will be unable to meet the demand for credit. That’s where the gap and opportunity exist for digital fintech players.

JP: Particularly when it comes to tier 2 and 3 cities, what are the big opportunities arising from the absence of a traditional credit score?

UR: Historically, credit scoring has been copied from the west. Credit bureaus there are far more advanced. They have been operational for 15 years and cover a significant population.

These models cannot be copy pasted to emerging markets like Indonesia.

Smartphone penetration is increasing along with enhanced digital data. There is an opportunity to mine that data whether it is from telcos, smartphones, ecommerce, shopping or ride hailing. Such very high frequency predictive data can then be used to build a credit score.

Embedded finance is a big upcoming area. Telcos or ride hailing services can leverage their large customer base and transaction data to create lending solutions.

JP: Stock investments have seen very low adoption in Indonesia. Some numbers say that less than 1% of the population are investors in capital markets. Even within this segment, millennials make up 70% or more. How do you explain this scenario?

Anderson Sumarli (AS): Indonesia is the largest capital market of its kind with the lowest investor penetration in the world. With a GDP per capita over $4,000 — twice that of India — people obviously have wealth. But Indonesia has traditionally embraced investments in land, livestock, gold — everything that’s basically not capital markets related.

Now, with low savings yield — most banks give you a quarter percent interest per year — and a high inflation rate at 2% to 2.5%, the middle-income segment is pushing towards risky assets that yield higher returns that can beat inflation.

Young people are staying home and maybe some of them were unfortunately affected economically by the pandemic. They are looking for ways to earn a side income. There are very few ways to do it from the comfort of your couch. As a result, people have begun dabbling with investment products.

When we talk about the bulk of investments coming from millennials, it’s a function of the rising middle class. In Indonesia, a majority of this segment is millennials.

JP: With the IDX talking about dual class shares which could potentially lead to many more Indonesian unicorns listing, does this have a potential for wealth creation?

AS: I believe capital markets are the ultimate tool to democratise finance. Any retail investor can buy a stock and participate in the benefits of this high growth nation. Valuations are increasing in the stocks, due to faster consumer adoption.

I really want to encourage some of my peers on this panel to list on the IDX. Part of me wants to appeal to their greed, but another part believes it is a social responsibility to allow the masses to participate in your success, given that you are based in Indonesia.

With such a young nation, here is an opportunity to build loyalty, where your consumers are not just using your products, but are also investors and want to see you succeed.

Jonathan Barki (JB): Wealth creation will also depend on which companies end up building the ecosystem. If we look at the key verticals such as ecommerce, digital payments and ride sharing, a lot of foreign firms, listed in different exchanges around the world, are serving these verticals.

As Indonesian business leaders, we need to ask ourselves: how much do we want to have a local brand or company to participate in that wealth creation, and to open the gateway for many more to follow?

This is the unifying spirit that the IDX has taken a lead on. Everybody shares the same aspirations. We hope we can open the floodgates for all Indonesian companies to access capital. And to give customers, stakeholders and retail investors access to wealth creation.

JP: To shift gears, a report from AWS found that only about 19% of the Indonesian workforce was digitally skilled and that Indonesia needs 110 million more digital workers by 2025. How do you see this shortfall being addressed?

Gunawan Susanto (GS): A lot of heavy lifting needs to be done. 59% of Indonesian digital workers who are not applying cloud computing skills today, believe they will be a requirement to perform their jobs by 2025. Cloud architecture, cyber security, large scale data modelling, web development, game development, and software operations will be the fastest growing skills.

Bridging this gap requires intentional and sustainable effort by all ecosystem players across the private and public sector. We’ve been collaborating with educational institutions, industry organisations, and of course, the government with local skilling initiatives to help students and the workforce keep pace. We provide a range of free training opportunities for the vast majority of people who want to develop their skills via self-paced learning. The 500 free courses include interactive labs and virtual day long training sessions.

For those who need the material to be in Bahasa Indonesia, we have developed a free localised digital training library with 80 courses. For our customers or organisations who prefer in person virtual classroom training, we provide accredited instructors.

JP: One big talking point in the Alpha JWC Ventures Kearney report is that despite increasing economic might in Indonesia, tier 2 and 3 cities are about 3 to 5 years behind a tier 1 city like Jakarta. How do you see the ecosystem pan out considering the needs of tier 2 and 3 consumers are likely to be different?

JB: Indonesia is an archipelago and that means separated clusters of hyperlocal environments.

When we think about cities outside tier 1, there is not enough density to create an ecosystem that has the network effects that benefit a technology platform. But that’s where the next wave of growth lies.

We have to be a first mover. If you build enough of a network effect and an ecosystem, you can create a significantly loyal and retentive customer base that will yield much longer-term benefits to the platform.

JP: Finally, what are the biggest challenges that you face in getting to tier 2 and 3 cities?

JB: The biggest risk is ourselves. How to curate and serve is very unique to customer segments. Fundamentally, it depends on our management team, our ability to build technical talent locally and to scale to drive that innovation.

AS: A big challenge is education because our product is talking about the store of wealth for individuals. It’s not a consumption product. We need to work with local officials as well as regulatory and government bodies, because we can’t go to these regions ourselves — since the economics do not make sense. It needs to be a public-private partnership.

Supercharging the growth of the B2B sector in tier 2 and 3 cities

The potential of P2P lending; bank licenses – both physical and digital; the bottlenecks to growth and the need for talent in areas like AI and machine learning were some of the subjects discussed in a panel on the potential of the B2B sector in Indonesia, organised by Alpha JWC Ventures.

The panel featured Iwan Kurniawan Co-Founder & COO, Modalku – Funding Societies; Andri Ngaserin Director & Head of Indonesia Research, Credit Suisse; Stevensang, Founder & CEO, GudangAda and Arip Tirta Co-Founder & President, Evermos and was moderated by Andi Haswidi Head of Research at DealStreetAsia.

The transformative effect of the COVID-19 pandemic was acknowledged across different sectors, with Stevensang from B2B tech firm GudangAda acknowledging that even the general trade in tier 2 and 3 towns had started the shift to digital platforms to restock orders. P2P lending firm Modalku also registered a sharp rise in customers looking to tap into its service. Interestingly enough, as Kurniawan said, “72% of our borrowers are applying for a loan for the first time ever. A high percentage of these applicants, or people who have already borrowed from us, are millennials – less than 40 years old.”

The digital wave was leaving no sector untouched. Credit Suisse’s Andri Ngaserin said, “Even large banks are reporting that the majority of transactions if not in value, but volume terms are done via the internet and mobile.”

However digital transformation still had a way to go before it was universally applied across Indonesia, according to the panellists. Evermos’s Arip Tirta pointed to the lack of engineering talent, particularly in forward looking spheres like machine learning and artificial intelligence.

Read on for edited excerpts:

AH: Separating myth from reality, can you please give us a view into how digitalisation has affected business over the past 12 months?

Stevensang (SS): A few years ago, we would not have been able to see traders stocking up digitally using ecommerce platforms, in tier 2 or 3 cities. Last year, when I visited the market, this had completely changed. First because smartphones are more affordable and secondly, because of government policy: actively creating programs to provide everyone with better internet access. This will accelerate economic growth.

FMCG traders, especially on the general trade side, are not tech savvy. We have an over 600-member business development team with a strong industry background, who take the traders on the journey together.

After two years, adoption has started increasing. We slowly ventured into tier 3 cities which are the hardest to crack because they have been very left behind.

Iwan Kurniawan (IK): Overall, we doubled our loan count from 2 million to 4 million in a year.

We conducted a survey and found that 72% of our borrowers are applying for a loan for the first time ever. A high percentage of these applicants, as well as our existing customers are millennials – below 40 years old.

Of these people, over 50 % did not have university education. Unlike the old generation who are used to going to a bank, they know that without collateral, good financial statements or a very big business, they may be rejected. We offer a solid alternative. In just one month in March last year, the number of people who came to our website jumped 20 times. It shows you the hunger and demand for SME loans.

Obviously, we did not approve most of them, since many were not in a good condition, but we are trying our best with those that we believe are worthy.

AH: Despite the progress that Indonesia has made over the past few years, what according to you are some of the remaining bottlenecks?

Arip Tirta (AT): Unfortunately, development among cities is different in terms of education, internet penetration, literacy, and infrastructure. With regard to digital transformation and economy, tier 1 and 2, have a much better access than lower tiers.

We have positioned ourselves around serving people who live in lower tier cities who are not tech savvy. They benefit from digital transformation by relying on our resellers who are tech savvy and who act like a concierge service for them.

IK: Specific to SME financing, the lack of financial records is our biggest enemy for second and third tier cities. We used to serve warungs in Indonesia and even in Jakarta, 40% to 50% do not have a bank statement. You can imagine how it is in warungs in tier 2 and 3 cities. Without active usage of an account where they can prove their credentials and credit worthiness, these markets are difficult to penetrate.

That’s why we work with ecommerce or supply chain partners, and focus on SMEs who have at least a bank account. It simplifies our operating model.

Another issue is internet connections. For finance products, there is always a need to upload information. When you type, slower connections are alright, but uploads could be several megabytes. We need more support from an infrastructure point of view.

AH: The commodity boom drove a lot of growth in tier 2 and 3 cities. Are we expecting growth on the back of another commodity boom?

AN: Commodities are definitely good, but very hard to predict or rely on, because they are cyclical by nature.

A country that relies more on innovation or cost leadership such as China, or encourages very creative entrepreneurs such as the US, can lead structural trends.

The entrepreneurs here are creating trends that may keep growing and generate more jobs. I would probably put my money on such trends, especially the tech wave which is enabling masses to do things that they could never have done before, and also helping SMEs to do business better.

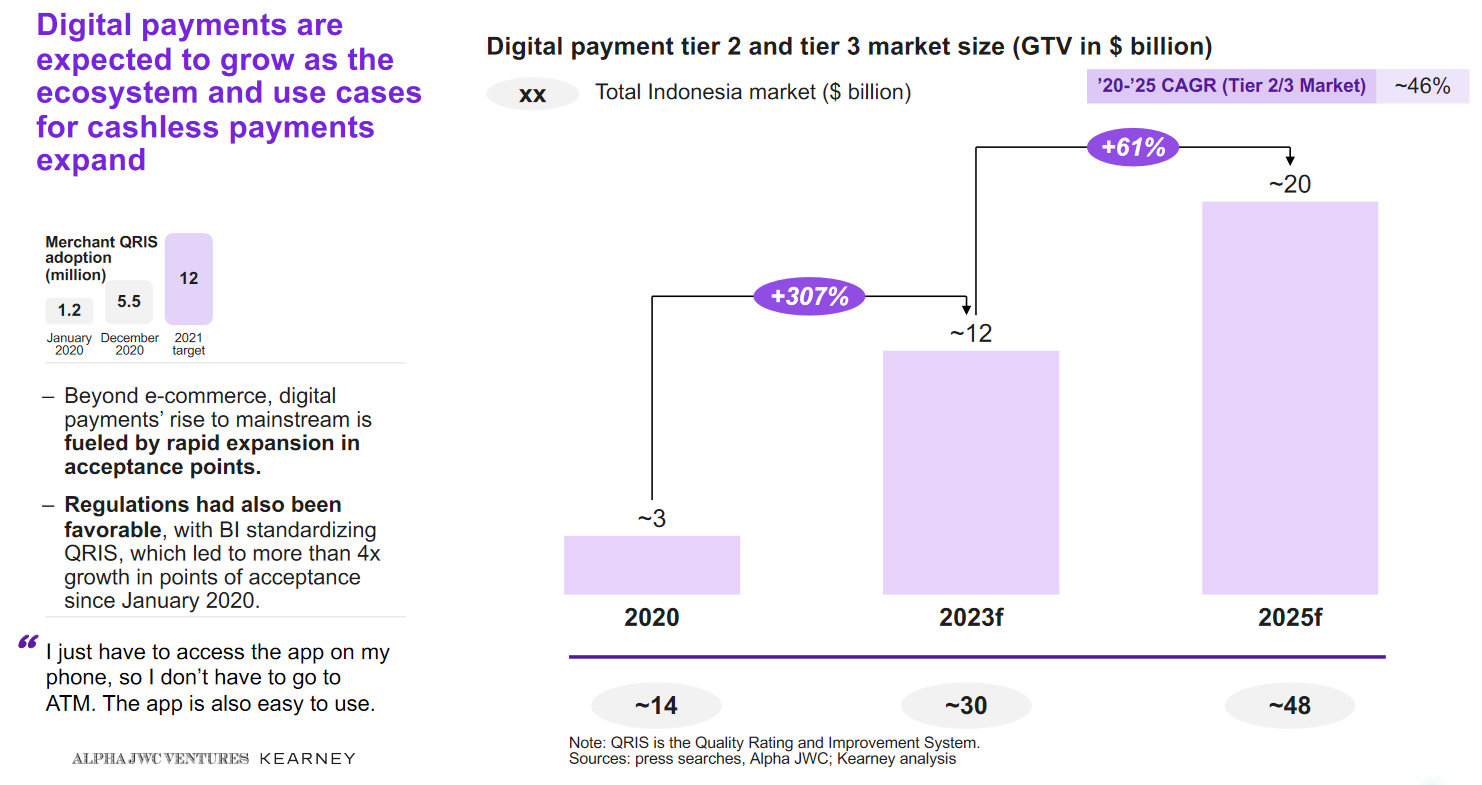

AH: What’s the state of digital payment adoption in Indonesia at the moment?

AN: Even large banks are reporting that the majority of transactions — if not in value but volume — are done via the internet and mobile. Everyone is trying to find a so-called value add within a particular banking journey.

Payment is one of them. When we first use online payment, it enables us to close the transaction easily in ecommerce. The second is discounts or QR-code based easy payment instead of cash.

Payment companies could then get into distributing mutual fund products, or even credit scoring. And finally, the advent of digital banking. At the moment, there is no single pure digital bank that has been launched. Instead, all major banks have their own app.

Once you have a bank inside your pocket and can access financial services, the state of play will change greatly across the whole value chain. The trend may take five to 10 years to develop because there’s inertia and players in tier 2 and 3 cities may not embrace it due to trust issues and language barriers. But all those problems will be solved over time.

AH: But the monetary authority has been trying to reduce the number of banks. Encouraging new applications does not really meet that goal. How will this play out?

AN: Even digital banks are discussing this at the moment, with the central bank. The central bank is getting feedback on whether it should have a pure digital bank license. With 107 banks, should 10 pure play digital banks be introduced, making it even more competitive?

The government policy is to reduce the number of banks. There are many reasons, all pointing towards avoiding systemic risk: a difficult to control situation where there is a NPL (non-performing loan) cycle.

To make an industry competitive, you don’t need 100 banks – even 20 will do. My suspicion is we probably will not need digital bank licenses, although I don’t have a firm conviction on this, because of the ever-changing dynamics.

AH: What do you make of players trying to join in the digital banking space by acquiring banks to expand their business?

IK: The biggest difference between a bank and a lender is that the bank can collect assets and facilitate payments between companies and consumers. For a number of P2P companies, the next destination is to either be strategically aligned with, acquire or co-own a bank.

But there are others who believe they have a very strong financing product or lending offering, that can grow even without bank ownership. You can still access a bank’s service without owning one.

What people don’t realize is how difficult it is to run a bank and how strongly regulated the sector is. In Hong Kong, a lot of businesses own digital banks but a majority of them are still trying to find their feet. There will be some consolidation. The dominant strategy for most players will be partnership.

AH: How far behind are homegrown players in Indonesia, when it comes to adoption of AI and machine learning?

AT: We are quite behind. The main issue is the lack of engineering talent. Even in more general engineering roles, we have problems with supply. The lack is even greater when it comes to AI and machine learning. We are five years behind, but the gap can be closed given we are innovating in a very fast moving and dynamic world.

We need to find a way to cross pollinate with other countries. Adopt AI and machine learning in our companies and get their talent to move to Indonesia and help us improve.

SS: Since the beginning, we have invested in a data warehouse. We are only two years old, but try to use data. We onboarded our CTO (Huan Yang) from Grab. He has experience building AI and machine learning systems. For now, we have around 70 people on our backend product team.

IK: We do have AI and use that for our work in Singapore in particular, which has a wonderful database of many financial and non-financial records.

In Indonesia, what we need is not necessarily AI but good product management and an understanding of how to grow. When the problem with customers is that they don’t even have the right structure or format of data, is it AI that that you need or something else?

Sometimes getting all the data reduces turnaround time and doesn’t give us what we need today. Good product management is understanding the pain points of the customer. Being able to grow with that constraint, is what’s really important most of the time.

This article is originally published in DealStreetAsia. Read the original article here.