Indonesian start-up scene is blooming at a fast rate. Indonesia has three unicorns to date — meaning that start-up founders are proving to the world that Indonesia has a lot of potential in technology sector. Alpha JWC Ventures is here to unlock Indonesia’s huge value and to bring Indonesia into a key player in the global technology stage.

Alpha JWC currently manages a US$ 50 million fund for high quality institutional investors in Asia, US and Europe. Alpha JWC sees opportunities in Fintech, SaaS, big data analytics, marketplace and e-commerce as high-potential investment trends, and have made compelling investments in leading tech start-ups within these sectors. Alpha JWC is planning to raise its next fund within the next year to continue its mission to bring Indonesian companies global and to capture compelling opportunities in backing visionary founders in Indonesia and Southeast Asia.

With seven investment professionals onboard and offices in Jakarta and in Singapore, Alpha JWC has a long experience and extensive knowledge in the sector both domestically and globally. Collectively, Alpha JWC’s co-founders have invested in more than 50 companies globally in the past decade with strong exit track record. Chandra Tjan, Alpha JWC’s Co-Founder, was the first investor in two Indonesian unicorns: Traveloka and Tokopedia, and he previously co-founded East Ventures.

Alpha JWC’s co-founders’ long experience in the market allows them to understand the market better and back some of the leading tech first movers, such as Funding Societies / Modalku, UangTeman, OnlinePajak, Sepulsa (all four are now the leading fintech in Indonesia), and Dattabot (Indonesia’s leading big data and analytics company).

“We believe in Indonesia and we understand the market very well. We have good connectivity with key tech stakeholders in neighboring countries and beyond, thus we are confident that Alpha JWC is in a unique position to capture tremendous value and work side by side with our founders to build a scaleable, sustainable and successful technology companies in Indonesia,” says Alpha JWC’s Co-Founder Jefrey Joe.

Alpha JWC takes a long-term approach when partnering with their founders. The Firm believes that relationship between a venture capital and a start-up should not be all about money. More importantly, it is about strong partnership to grow together. Alpha JWC works closely with companies’ founders and strive to be a value-adding partner, from helping with recruitment of the right talent, revenue-generating business development, business model and growth strategy, and operations improvement. In addition, the Firm invests from seed to series B and the sizeable fund allows Alpha JWC to continue to support the founders meaningfully as they grow.

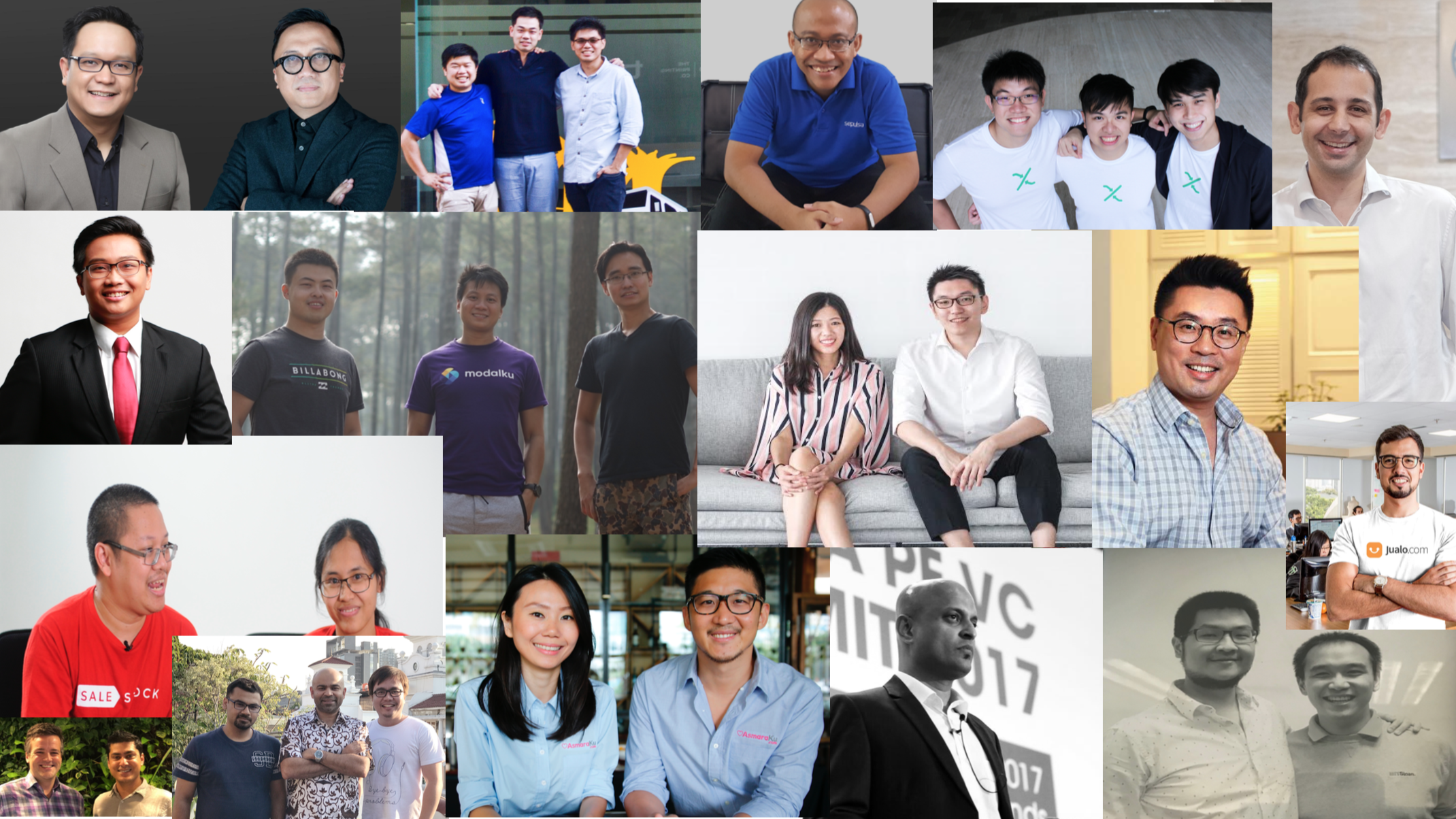

Alpha JWC has a clear investment thesis. The Firm currently invests in 15 companies, ranging from co-working space (Spacemob), fintech (Funding Societies / Modalku, UangTeman, OnlinePajak, Sepulsa), marketplace (Carro), to e-commerce (StyleTheory and Sale Stock). Alpha JWC has also established strong institutional following with later-stage global investors such as Softbank and Sequoia Capital. The Firm recently has an exit`, as Spacemob was acquired by WeWork in August 2017.

Alpha JWC continues its mission as a thought leader by being actively engaged in Indonesian tech community. In addition, the Firm is now expanding and has moved to Spacemob WeWork Jakarta to actively support the growth of Indonesian tech ecosystem to bring Indonesian tech start-ups to the world stage.